Pragma Group

Pragma Group partnered with myHSA to deliver a unique solution for your employee benefit plans.

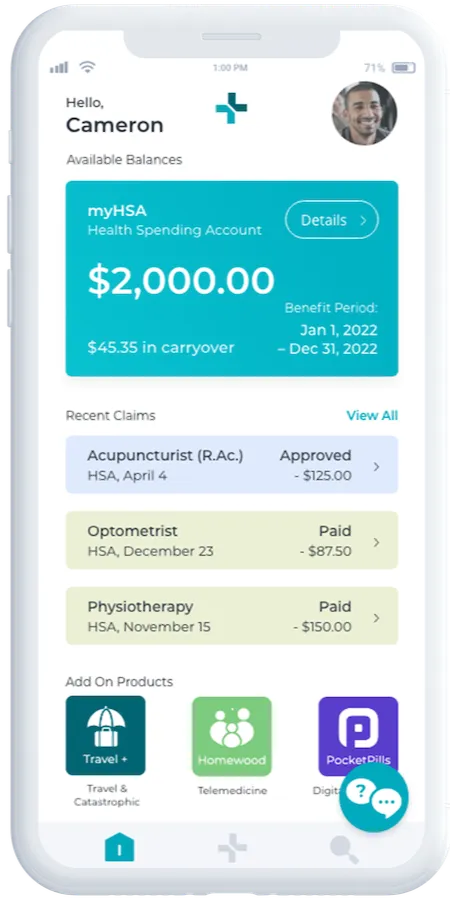

myHSA™ – Health Spending Account

An HSA provides a non-taxable alternative or supplementation to a traditional benefits plan. HSA eligible expenses are vast, ranging from dental, vision, professional services, & hospital bills.

myWSA™ – Wellness Spending Account

A taxable account to promote healthier lifestyles – incentivize employees with eligible categories like gym memberships, holistic medicine, personal development courses, and more! Customize this list for employee needs.

myFlexplan™ – Flexible Spending Account

Combine an HSA with the options of a wellness account (WSA) and/or RRSP, or other categories—offering personalized employee benefits.

myASO™ – Administrative Services Only

Taxable & tax-free account – drill down to the sub-item level and customize lists with category limits & yearly caps.

myHSA Employee Benefit Plans

Cater plans for multiple generations across the workforce, incentivizing employee health and wellness.

myHSA’s partnerships allow a range of add-ons to pair well with plans. Offer products in addition to plans, as standalone products, or let employees choose through our Marketplace with voluntary products.

Add-on products include:

Mental Healthcare, Virtual Wellness, Digital Wills, Critical Illness, Telehealth, Travel Insurance

Frequently Asked Questions

What is a health spending account?

An HSA is a cost-efficient alternative to traditional insurance plans, providing a spending account to employees for reimbursing eligible expenses over the benefit year. Health expenses offered through an HSA are 100% tax-deductible to the employer while received 100% tax-free by employees.

How does the claim process work?

Employees pay out of pocket for eligible expenses – listed on their dashboard – and submit a claim online or through the app. Employees must include their receipt, either attaching a copy or snapping a picture to upload on the app. Once the claim is approved, claim amounts are pulled from corporate accounts every Wednesday and Friday, and funds are reimbursed into employees’ bank accounts within one to three business days.

Can I qualify for a spending account as an individual incorporated business owner?

Employees pay out of pocket for eligible expenses – listed on their dashboard – and submit a claim online or through the app. Employees must include their receipt, either attaching a copy or snapping a picture to upload on the app. Once the claim is approved, claim amounts are pulled from corporate accounts every Wednesday and Friday, and funds are reimbursed into employees’ bank accounts within one to three business days.

Can I build out specific plans for different employees?

Yes, as a business owner, when setting up your HSA, we guide you through setting employee classes – a way to distinguish employees at the company, whether that’s senior staff, managers, or full-time staff. Each class is allotted a set dollar amount for their spending account, and employers have the choice to determine the maximum limits per class and assign appropriate employees to said class. Also, you have the flexibility to decide whether the carryover of unused funds into the next benefit year is eligible for employees.

Does myHSA offer other plan options or customized HSAs?

Yes, myHSA offers varying plan options and levels of customization. Whether you want to mimic traditional insurance plans, incentivize wellness with a WSA, offer a top-up solution, or combine the HSA and WSA for a more flexible employee offering. When setting up, we walk you through it – you control the plan design to fit your employees’ needs.